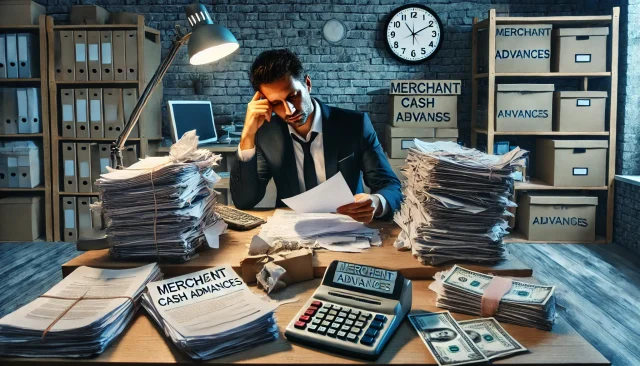

Procrastination - Failing to take action

Delegating Tasks - Stops Procrastination

"When it comes to obtaining financing for their business, I find that the number one issue business owners face is procrastination. In most every other area of their business they are at the top of their game. But in this specific issue, many owners assume their talent and experience will suffice and translates into this arena, leading them to handle everything on their own and avoid delegating the necessary tasks and responsibilities. Instead of asking proactive questions like 'What can I do differently today to change the course of my companies financial issue?', they get stuck asking 'How come I am in this situation?' or 'Why is this happening?' This mindset traps them in a cycle of fear, guilt, frustration, and embarrassment, preventing them from addressing the looming financial crises that they are in or ahead of them. They fall back on quick options and rely on short-term solutions and assumed abilities, hoping projected future profits and new business will solve their problems. When I offer solutions requiring extra effort and time, they often delay taking action. They listen to others offering cash advances, in first, second, third, or even fourth positions to resolve the short-term crisis. The person offering this solution has likely never struggled with making payroll, being late on taxes, dealing with canceled business, or facing an industry downturn.

Therefore, when making a decision to delegate a solution for long-term resolution, negotiate your way through your situation, and hire an experienced hands-on expert, it's crucial to ask four questions of anyone offering quick solutions: How long have you been doing this? Have you ever run a small business? What was it, and why are you not running it now? To truly change course, take action, delegate wisely, and shift your focus from 'How' and 'Why' to 'What can I do?' If they haven't walked in your shoes, then don't listen to their solution." - Todd Myers

Overcoming procrastination as a business owners when you need to transition from Merchant Cash Advances (MCAs) to bank financing can be challenging. Here are some effective strategies to encourage yourself to take action and reduce procrastination:

1. Educate and Inform

Highlight the Benefits In Your Situation: Clearly communicate the advantages of bank financing over MCAs, such as lower interest rates, better terms, and the long-term financial health of the business. Manage defaults easer, mitigate risk, and control access to your accounts. Bank financing is regulated by the government, MCA's are not regulated, so if your default you will loose control of your finances fast.

Review Examples & Case Studies: Read and research success stories of other business owners who have made the transition and benefited from bank financing.

2. Simplify the Process

Break Down Tasks: Divide the overall goal into smaller, manageable tasks with clear deadlines. This makes the process less overwhelming. Give yourself a realistic goal of 3 to 5 months to get your personal credit in order, taxes and financials ready, start using your business account for only business and get rid of negative days and overdrafts for the 90-days prior to applying for bank financing.

Provide Checklists: Create step-by-step checklist of what needs to be done, making it easier for them to track their progress. Include a lawsuit search, UCC Filing search, and ask the credit reporting companies to remove all old, and inaccurate names and addresses to prevent fraud. In addition, it will help when disputing old, inaccurate, credit associate with those names and addresses.

3. Hire A Business Consultant or Assign to A Staff Member, Get Support and Resources

3. Hire A Business Consultant or Assign to A Staff Member, Get Support and Resources

Personalized Assistance: Provide one-on-one coaching or mentoring to guide them through the process.

Resource Materials: Download and obtain templates, guides, and resources to make the tasks easier to complete.

4. Set Clear Deadlines

Create a Timeline: Develop a timeline with specific deadlines for each task. This helps create a sense of urgency and accountability.

Regular Check-ins: Schedule regular check-ins to review progress and address any concerns or obstacles.

5. Leverage Accountability

Accountability Partners: Pair them with an accountability partner, such as a business advisor or a peer, who can help keep them on track.

Regular Reporting: Require regular updates on their progress, creating a sense of responsibility to stay on course.

6. Incentivize Action

Offer Incentives: Provide rewards for completing tasks on time, such as discounts on services or access to additional resources.

Highlight Consequences: Explain the potential negative consequences of continuing to rely on MCAs, such as higher costs and increased financial strain.

Highlight Consequences: Explain the potential negative consequences of continuing to rely on MCAs, such as higher costs and increased financial strain.

7. Address Psychological Barriers

Overcome Fear: Address any fears or misconceptions they may have about the process of obtaining bank financing.

Boost Confidence: Encourage and build their confidence by celebrating small wins and milestones achieved along the way.8. Utilize Technology

Automate Tasks: Use technology to automate parts of the process, such as financial data collection and document submission.

Digital Tools: Provide access to digital tools and platforms that streamline the application process and make it more user-friendly.

9. Provide a Clear Vision

Future Planning: Envision the future benefits of improved financing, such as business growth and stability.

Set Goals: Set long-term goals that bank financing can help achieve, creating motivation to complete the necessary tasks.

By combining these strategies, you can help your business overcome procrastination and take the necessary steps to secure bank financing, ultimately leading to more sustainable and favorable financial solutions for their businesses.